FRM-Option

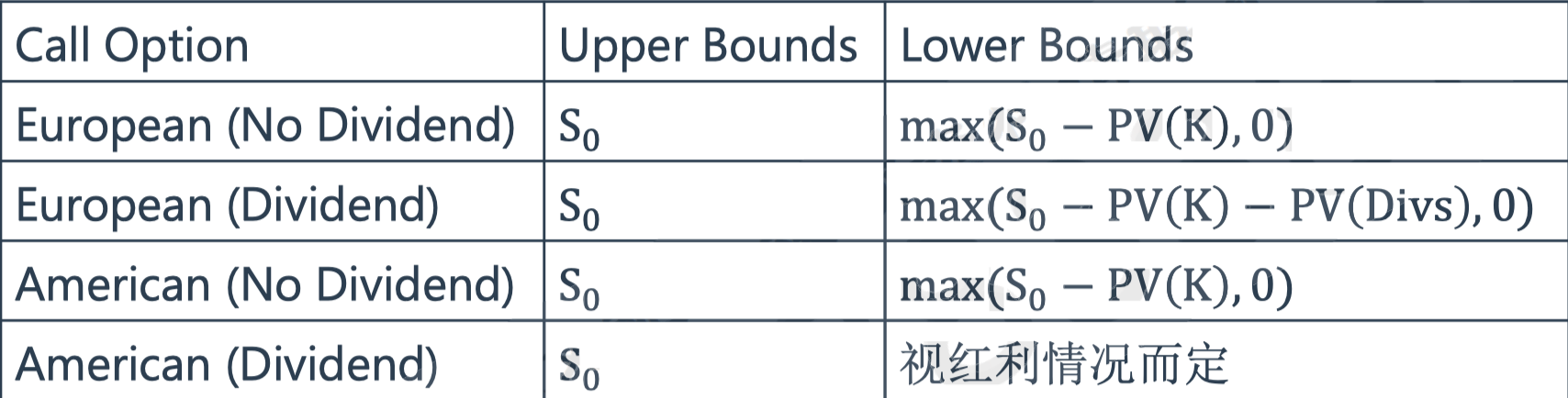

Properties of options

Call options

Put options

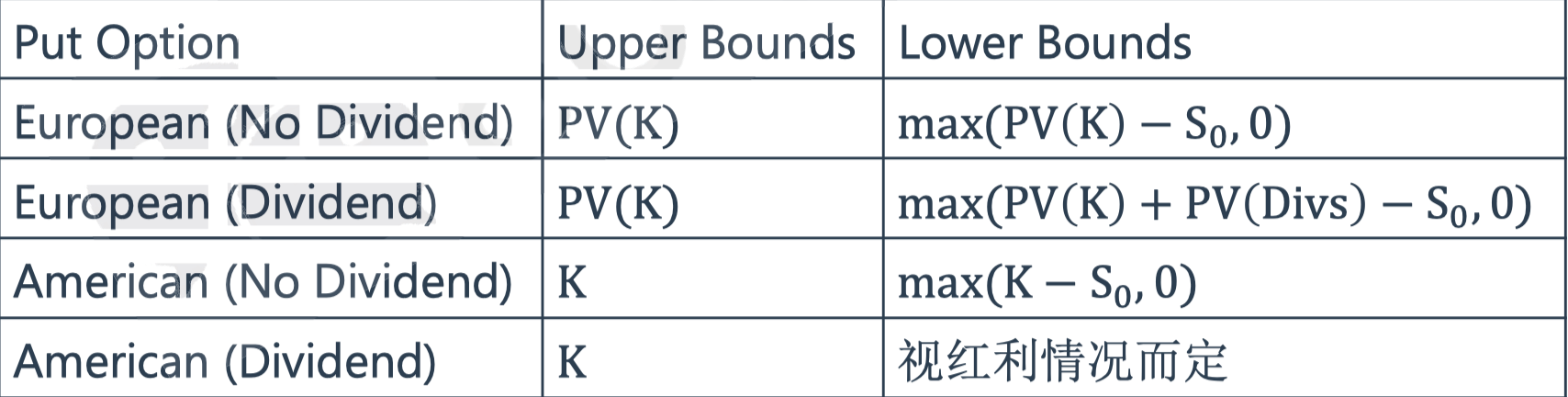

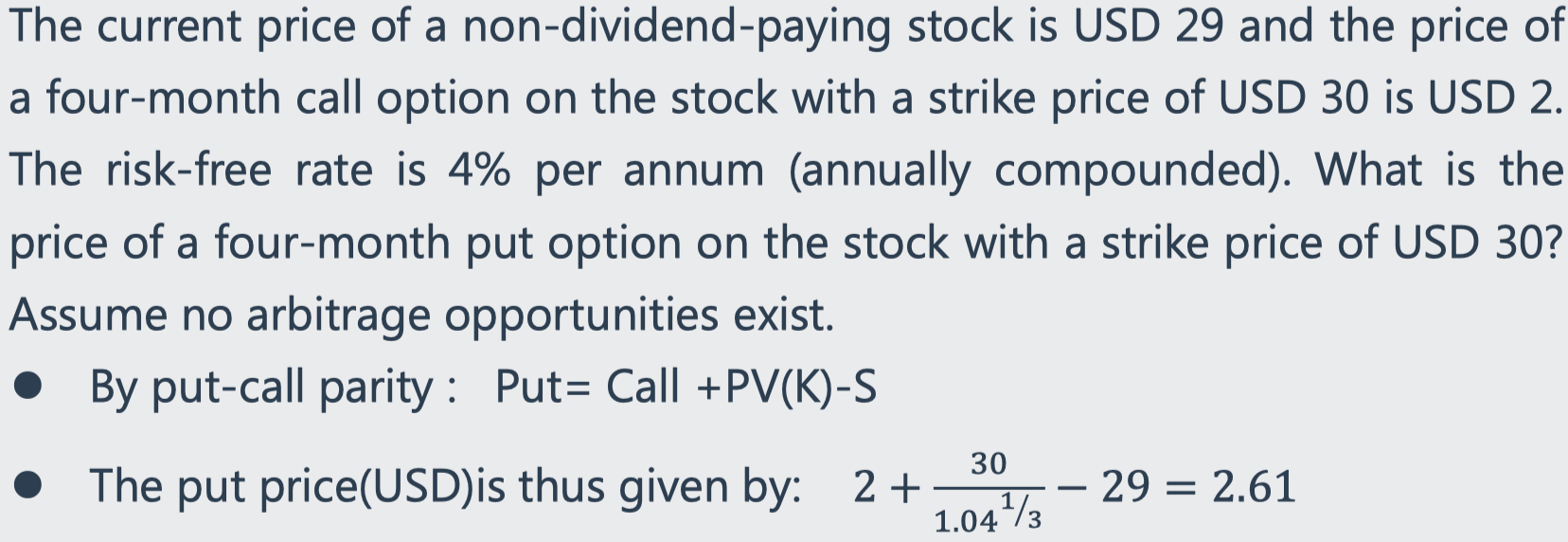

Put-call Parity

\[ P+S=C+PV(K) \]

European option -- same underlying, strike, maturity

Div adjustment

- discrete: \(P+S-D=C+Ke^{-rt}\)

- discrete rate q: \(P+Se^{-qt}=C+Ke^{-rt}\)

annual compound: \(P+S=C+\frac{K}{(1+R_f)^t}\)

American option: no exact relationship

Portfolio construction

\[ P+S=C+Ke^{-rt} \\ P=C+Ke^{-rt}-S \]

long put = long call, long zero-compound bond, short stock

Arbitrary

\[ P+S (buy)<C+Ke^{-rt}(sell) \]

###Pricing

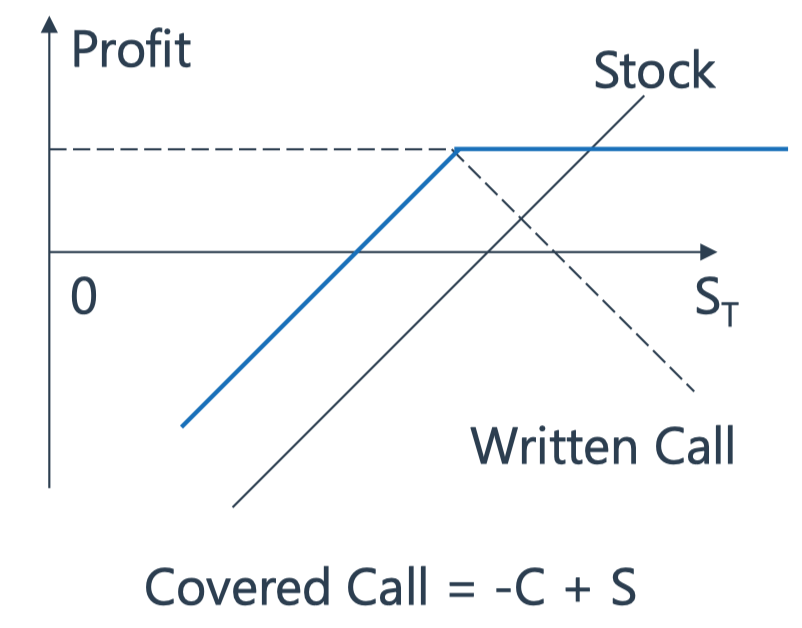

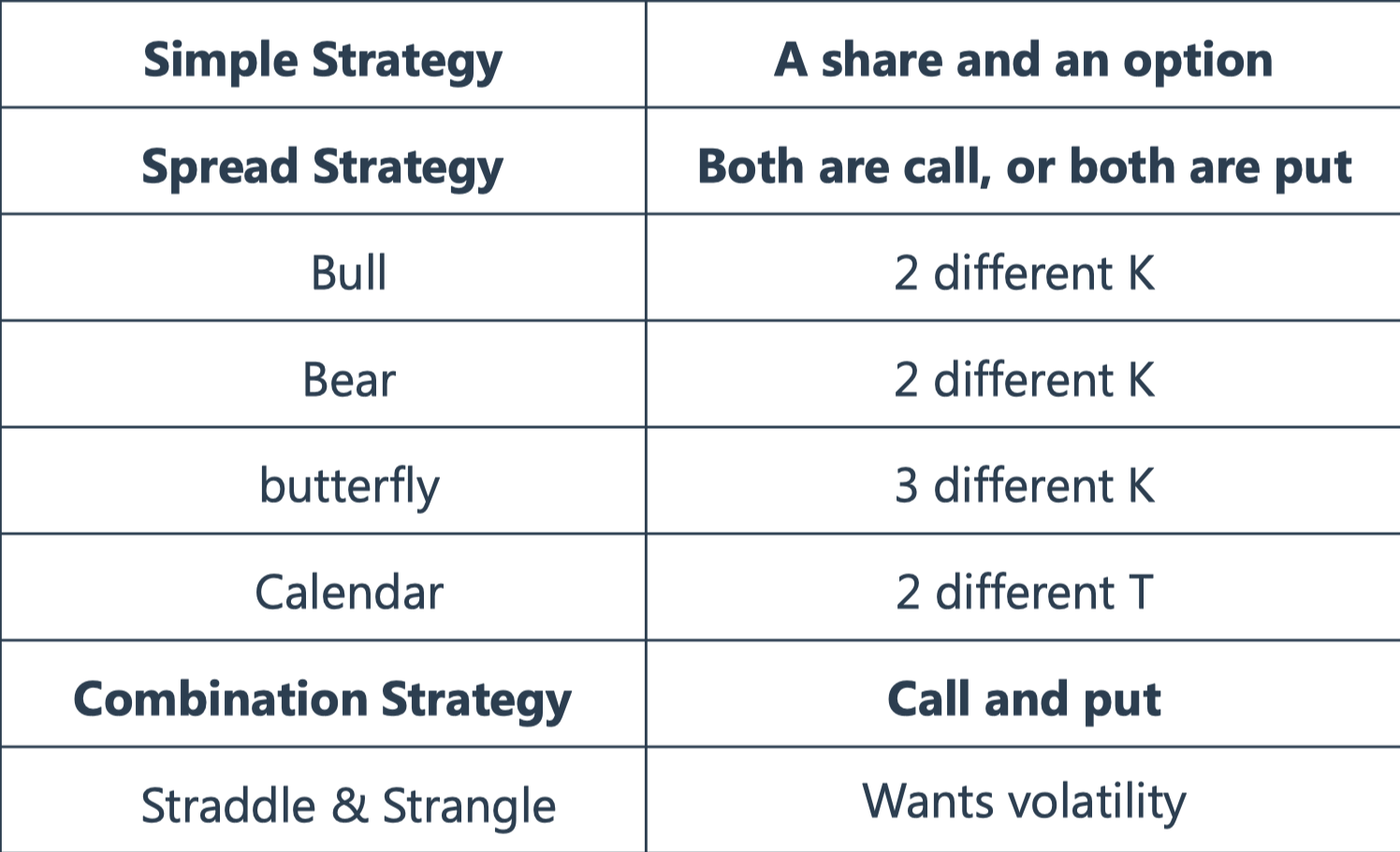

Simple Strategies

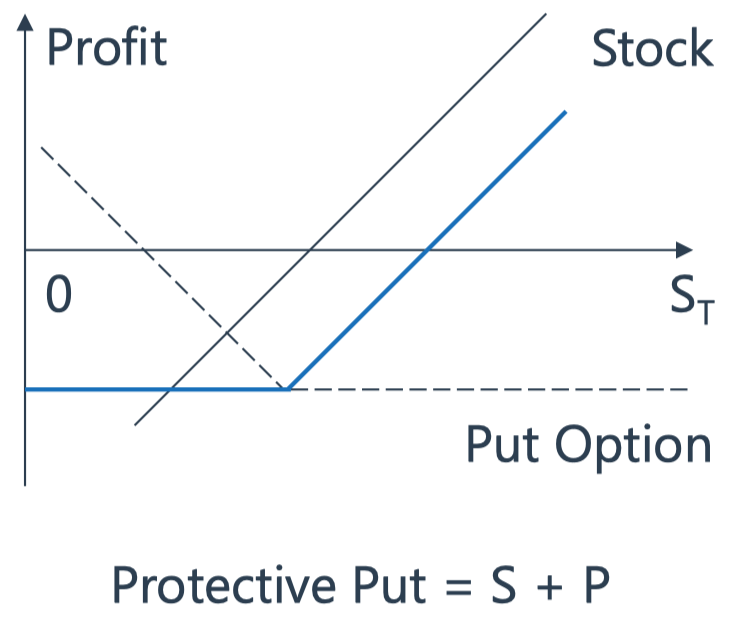

option + underlying

Covered Call

Protective Put

Principal Protected Notes(PPN)

- A PPN is structured as a zero-coupon bond and an option with a payoff that is linked to an underlying asset, index, or benchmark.

- It guarantees a minimum return equal to the investor's initial investment (the principal amount), regardless of the performance of the underlying assets.

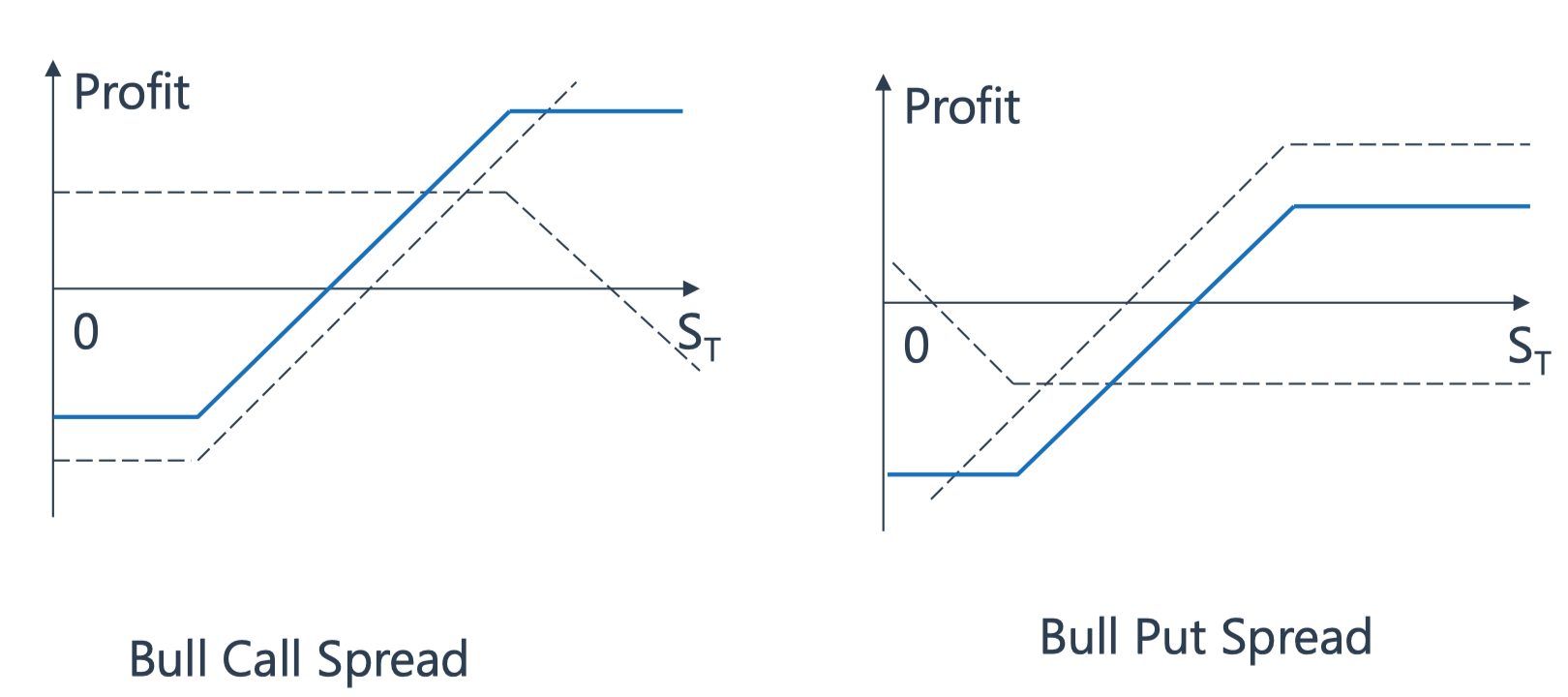

Spread Strategies

Bull spread

outlook is bullish, buy low sell high ~ 低买高卖,行权价格

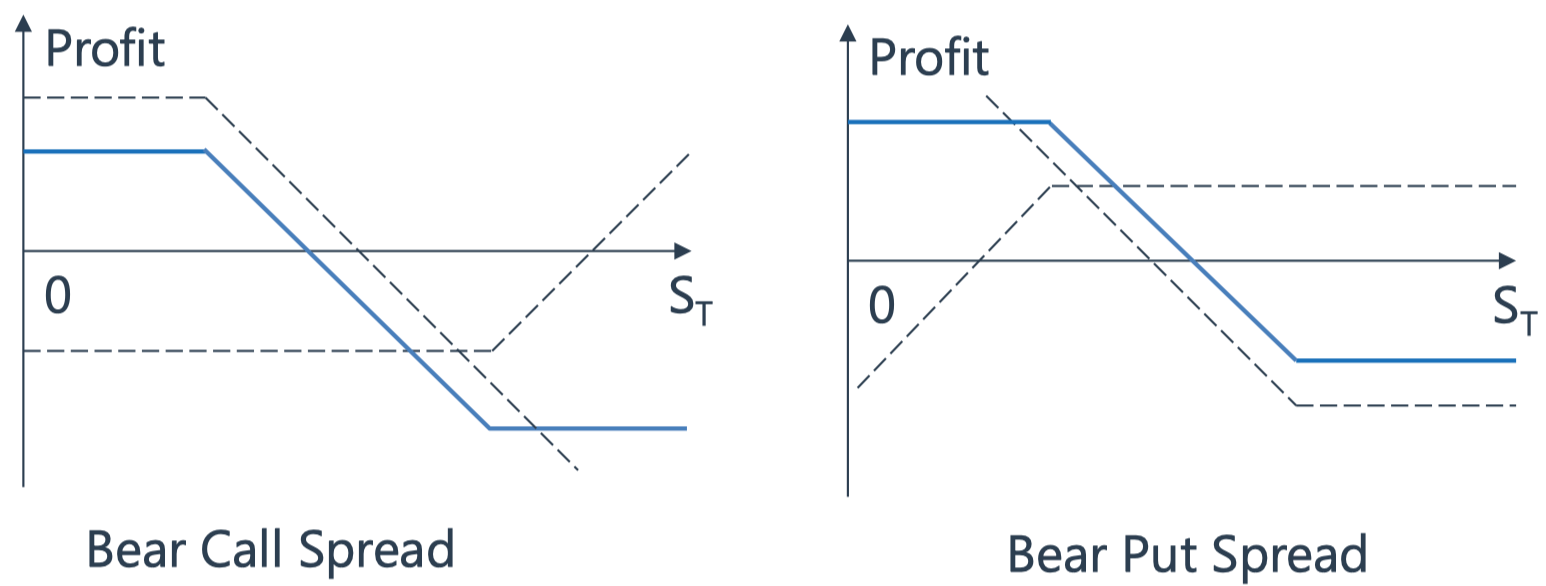

Bear Spread

outlook is bearish, buy high, sell low

Box spread

- A box spread is a combination of a bull call spread with strike prices \(K_1\) and \(K_2\) and a bear put spread with the same two strike prices.

- The payoff from a box spread is always \(K_2 – K_1\) .

- Box spread = Bull spread + Bear spread

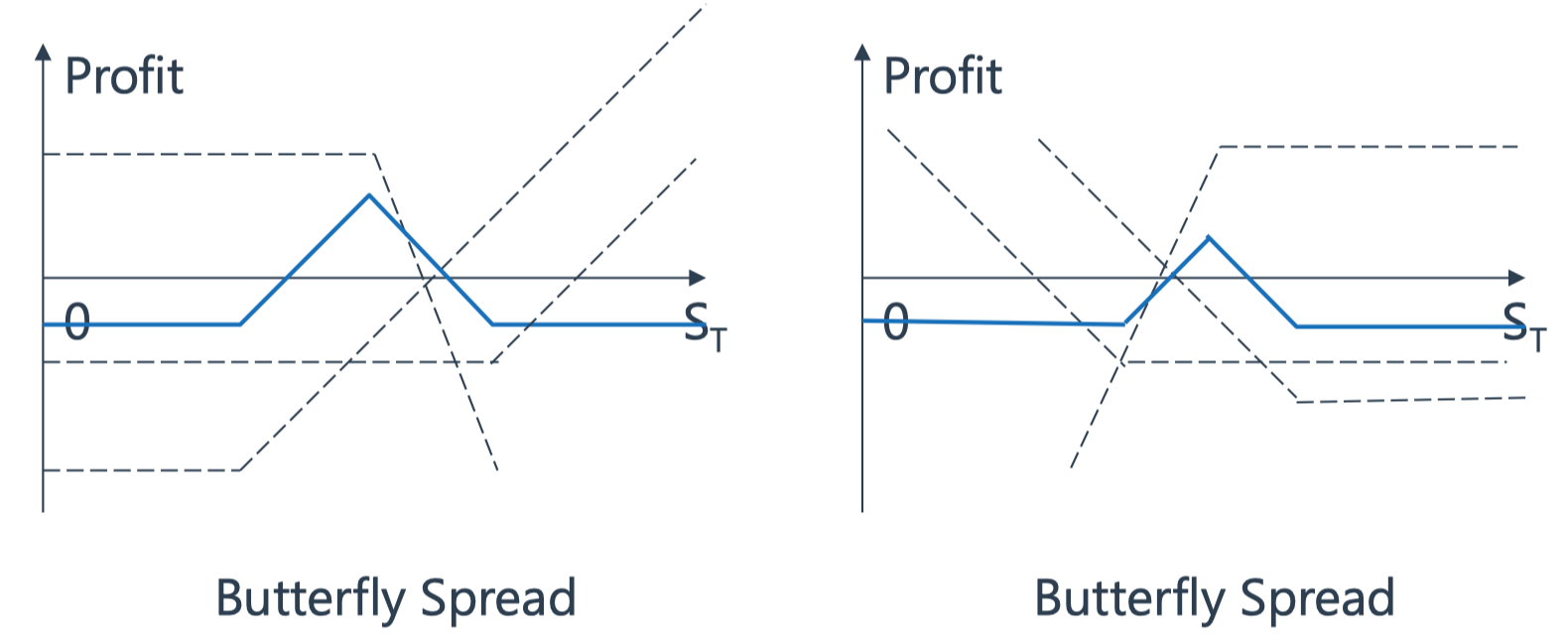

Butterfly Spread

long option \(k_1\), long option \(k_3\), short option \(k_2\), \(k_2=\frac{k_1+K_3}{2}\)

Expects low volatility

Capped risk

Calender Spread

long long-term, short short-term

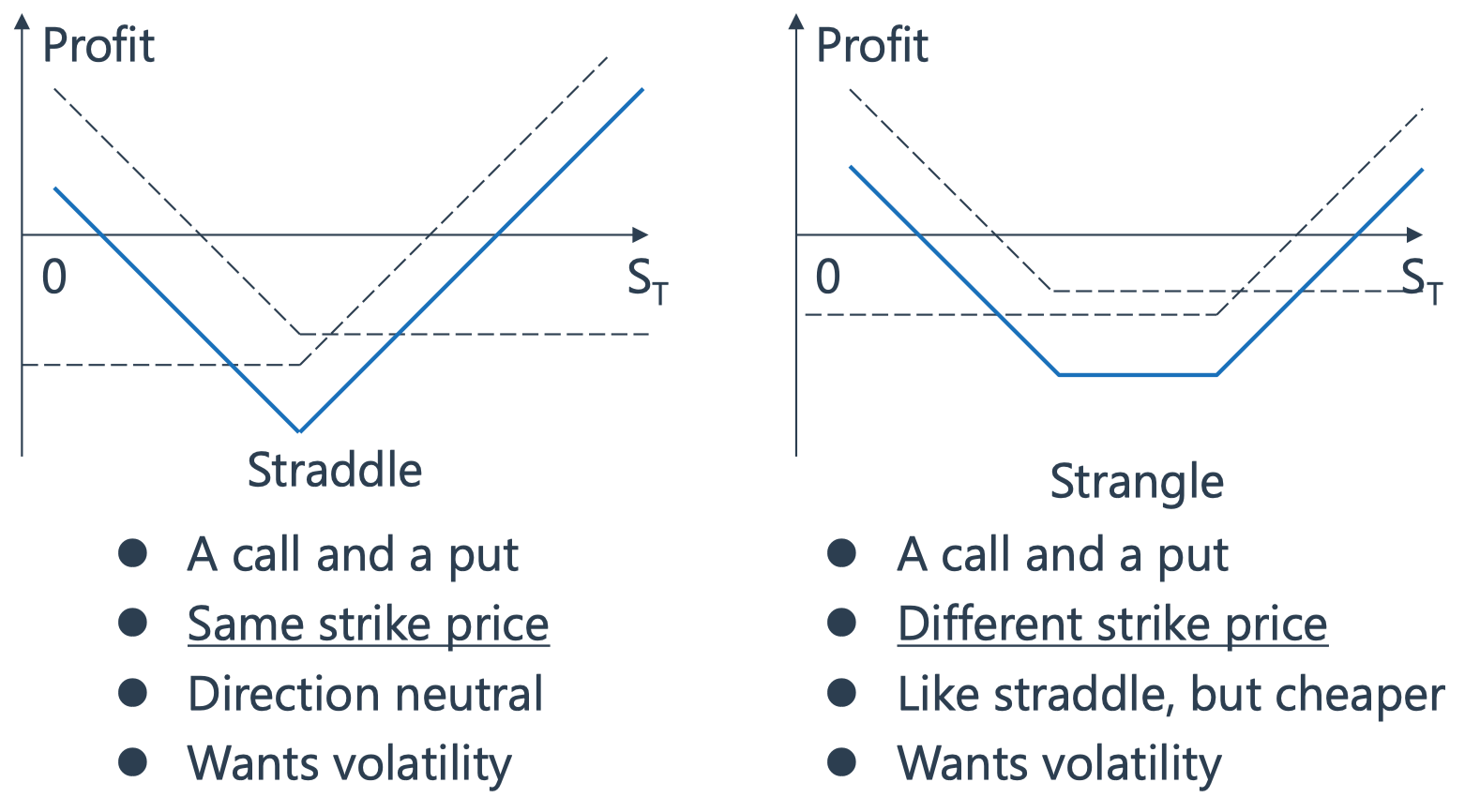

Combination Spread

Call+Put

Straddle and Strangle

Strangle is cheaper than straddle——购买高行权价格的看涨期权,购买低行权价格的看跌期权,期权费更加便宜。

Exotic Option

Gap Option

- Call gap option

- \(S_T>K_2\), \(Payoff=S_T-K_1\)

- Put option

- \(S_T<K_2\), \(Payoff=K_1-S_T\)

Forward Start option

A forward start option is an advance purchase of a put or call option that will become active at some specified future time. It is essentially a forward on an option

Compound option

Options on options

A call on a call, a put on a call, a call on a put, and a put on a put

If both options are exercised, the total premium will be more than the premium on a single option

Chooser option

After a specified period of time, the holder can choose whether the option is a call or a put.

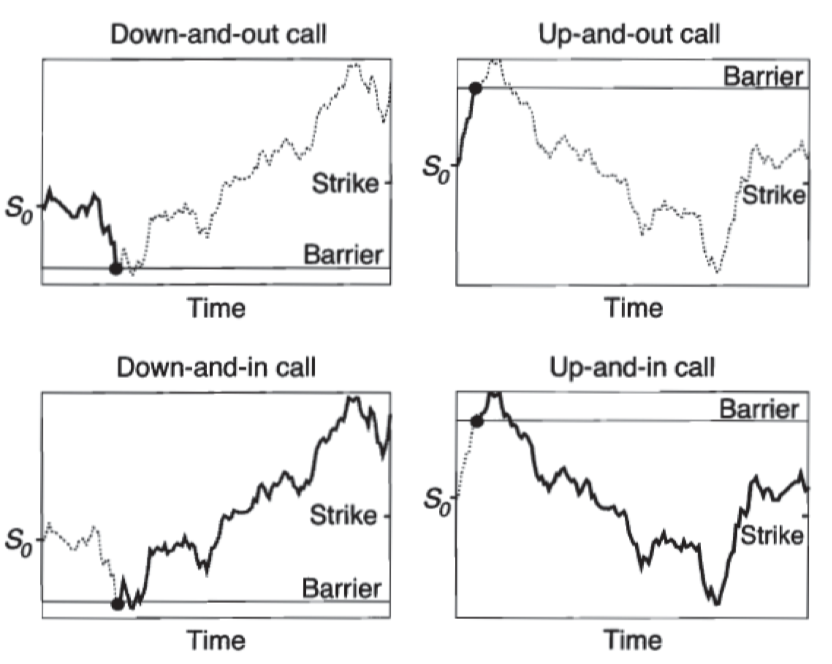

Barrier Option

Payoffs and existence depend on whether the underlying’s asset price reaches a certain barrier level over the life of the option.

A knock-out option ceases to exist when the underlying asset price reaches a certain barrier while a knock-in option comes into existence only when the underlying asset price reaches a barrier.

==In-out parity==

down-and-out call + doan-and-in call = call option

Binary options

- ==Cash-or-Nothing== : Pays some fixed amount of cash if the option expires in-the-money.

- ==Asset-or-Nothing== : Pays the value of the underlying security.

- A regular European call option is equivalent to a long position in an asset-or-nothing call and a short position in a cash-or-nothing call.

- A regular European put option is equivalent to a long position in a cash-or-nothing put and a short position in an asset-or-nothing put.

Call option = long asset or nothing call + short cash or nothing call

Put option = long cash or nothing put + short asset or nothing put

Lookback options

- Payoffs depend on maximum or minimum price of the underlying asset

- With floating strike and with fixed strike

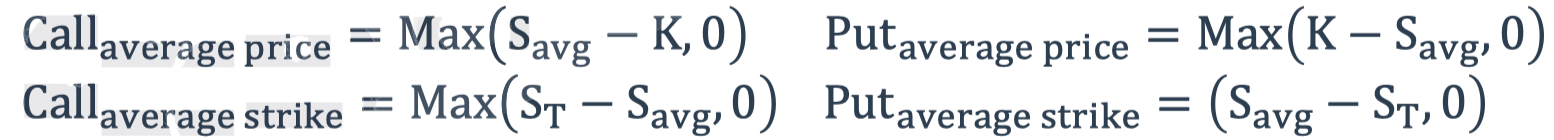

Asian options

- Payoff dependon arithmetic average of the underlying asset price

- Average price option and average strike option.

==Path-dependence==

Volatility and Variance Swap

Volatility Swap

Exchanging of volatility based on a national principal

Payments base on pre-specified volatility and realized volatility.

Variance Swap

- Exchanging pre-specified fixed variance rate for realized variance rate

Static options Replication

This technique involves searching for a portfolio of actively traded options (regular options) that approximately replicates the exotic option. Shorting this position provides the hedge.