Macroeconomics Review

- One way to view GDP is as the total income of everyone in the economy; another way is as the total expenditure on the economy’s output of goods and services

- National Income Accounting, the system used to measure GDP and many related statistics.

- A stock is a quantity measured at a given point in time, whereas a flow is a quantity measured per unit of time.

- The Treatment of Inventories

- spoil: not alter GDP

- put into inventory: GDP rises (regarded as the owner bought the inventory)

- GDP includes only the value of final goods.

- Economists call the value of goods and services measured at current prices Nominal GDP. Notice that nominal GDP can increase either because prices rise or because quantities rise.

- Real GDP, which is the value of goods and services measured using a constant set of prices. That is, real GDP shows what would have happened to expenditure on output if quantities had changed but prices had not.

- The GDP deflator is the ratio of nominal GDP to real GDP

- GDP Deflator = \(\frac{\text{Nominal GDP}}{\text{Real GDP}}\)

- The GDP deflator reflects what’s happening to the overall level of prices in the economy.

- GDP is the sum of consumption, investment, government purchases, and net export

- The general rule is that the economy’s investment does not include purchases that merely reallocate existing assets among different individuals.

- Whereas GDP measures the total income produced domestically, GNP measures the total income earned by nationals (residents of a nation).

- To obtain net national product (NNP), we subtract from GNP the depreciation of capital—the amount of the economy’s stock of plants, equipment, and residential structures that wears out during the year

- NNP = GNP - depreciation

- National Income = NNP - Statistical Discrepancy.

- Disposable Personal Income = Personal Income - Personal Taxes.

- The most commonly used measure of the level of prices is the consumer price index (CPI).

- producer price index (PPI), which measures the price of a typical basket of goods bought by firms rather than consumers.

- The Difference Between Cpi&GDP Deflator

- GDP deflator measures the prices of all goods and services produced, whereas the CPI measures the prices of only the goods and services bought by consumers.

- GDP deflator includes only those goods produced domestically. Imported goods are not part of GDP and do not show up in the GDP deflator. Hence, an increase in the price of Toyotas made in Japan and sold in this country affects the CPI, because the Toyotas are bought by consumers, but it does not affect the GDP deflator.

- The CPI assigns fixed weights to the prices of different goods, whereas the GDP deflator assigns changing weights

- Economists call a price index with a fixed basket of goods a Laspeyres index and a price index with a changing basket a Paasche index

- CPI is a Laspeyres index, it overstates the impact of the increase in orange prices on consumers: by using a fixed basket of goods, it ignores consumers’ ability to substitute apples for oranges.

- GDP deflator is a Paasche index, it understates the impact on consumers: the GDP deflator shows no rise in prices, yet surely the higher price of oranges makes consumers worse off.

- The PCE deflator is calculated like the GDP deflator but, rather than being based on all of GDP, it is based on only the consumption component of GDP. That is, the PCE deflator is the ratio of nominal consumer spending to real consumer spending.

- CPI tends to overstate inflation

- substitution bias

- doesn't reflect the ability of consumers to substitute good

- introduction of new goods

- introduction of new goods increased the real value of the dollar

- this increase in the purchasing power of the dollar is not reflect in a lower CPI

- unmeasured changes in quality

- substitution bias

- Unemployment Rate is the statistic that measures the percentage of those people wanting to work who do not have jobs

- Labor Force = Number of Employed + Number of Unemployed

- Unemployment Rate = \(\frac{\text{Number of Unemployment} }{\text{Labor Force} }\)

- Labor-Force Participation Rate = \(\frac{\text{Labor Force}}{\text{Adult Population}}\)

- Gross domestic product (GDP) measures the income of everyone in the economy and, equivalently, the total expenditure on the economy’s output of goods and services.

- Nominal GDP values goods and services at current prices. Real GDP values goods and services at constant prices. Real GDP rises only when the amount of goods and services has increased, whereas nominal GDP can rise either because output has increased or because prices have increased. The GDP deflator is the ratio of nominal to real GDP and measures the overall level of prices.

- GDP is the sum of four categories of expenditure: consumption, investment, government purchases, and net exports.

- The consumer price index (CPI) measures the price of a fixed basket of goods and services purchased by a typical consumer relative to the same basket in a base year. Like the GDP deflator and the personal consumption expenditure (PCE) deflator, the CPI measures the overall level of prices, but unlike the deflators, it does not allow the basket of goods and services to change over time as consumers respond to changes in relative prices.

![image-20200104224717762]()

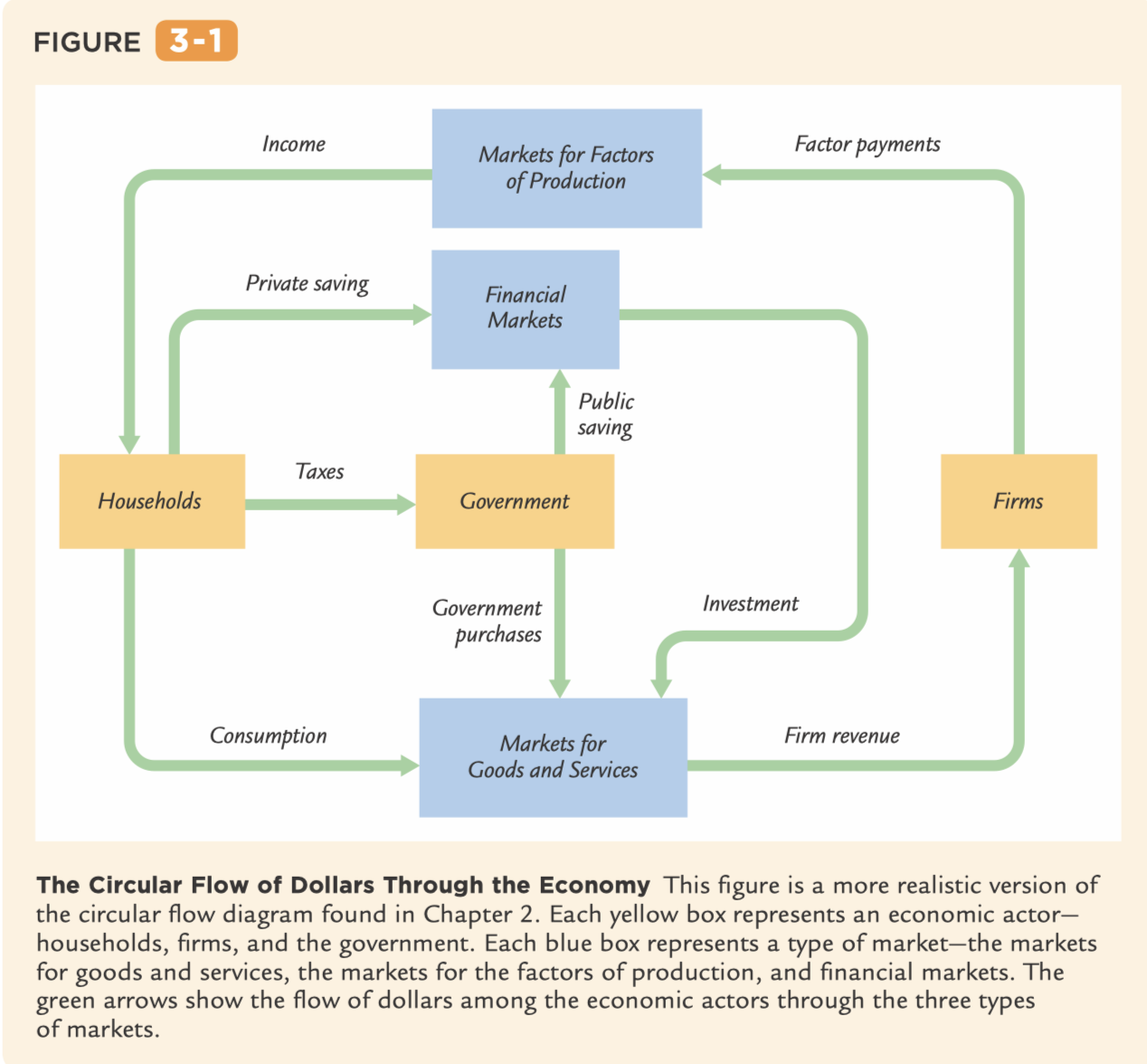

- The government receives revenue from taxes and uses it to pay for government purchases. Any excess of tax revenue over government spending is called public saving, which can be either positive (a budget surplus) or negative (a budget deficit).

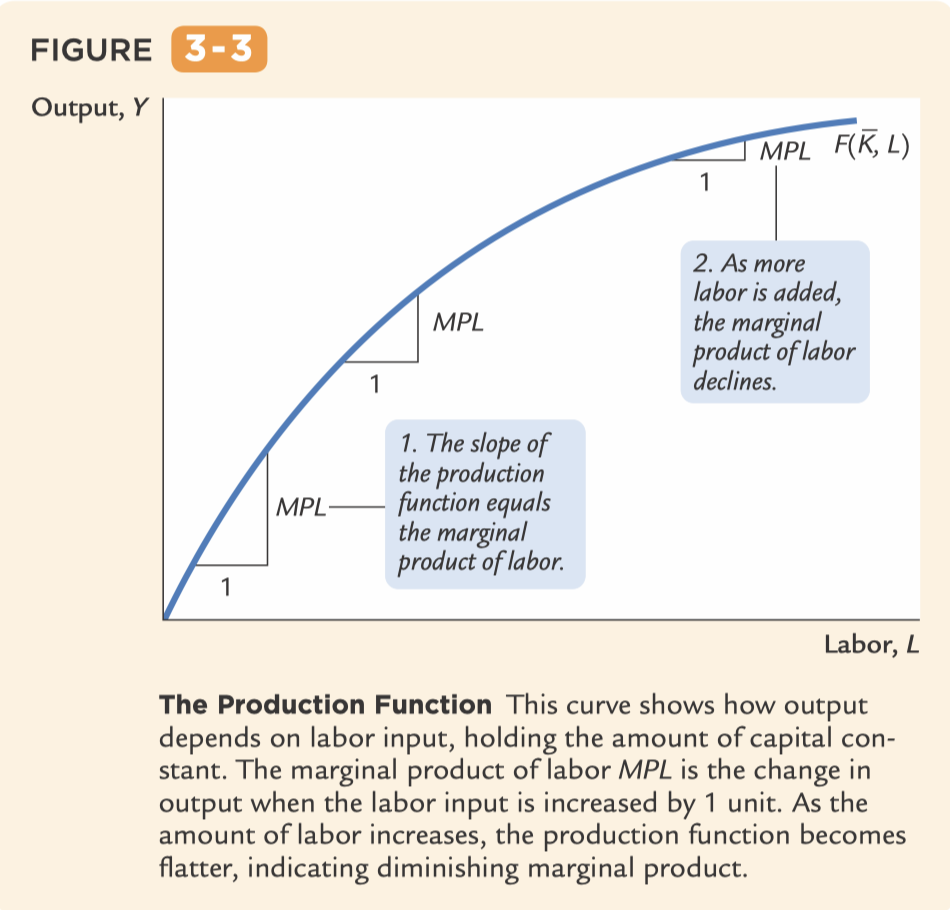

- The marginal product of labor (MPL) is the extra amount of output the firm gets from one extra unit of labor, holding the amount of capital fixed.

- W/P is the real wage—the payment to labor measured in units of output rather than in dollars. To maximize profit, the firm hires up to the point at which the marginal product of labor equals the real wage.

- The firm demands each factor of production until that factor’s marginal product falls to equal its real factor price.

- The Gini coefficient is a measure of income dispersion

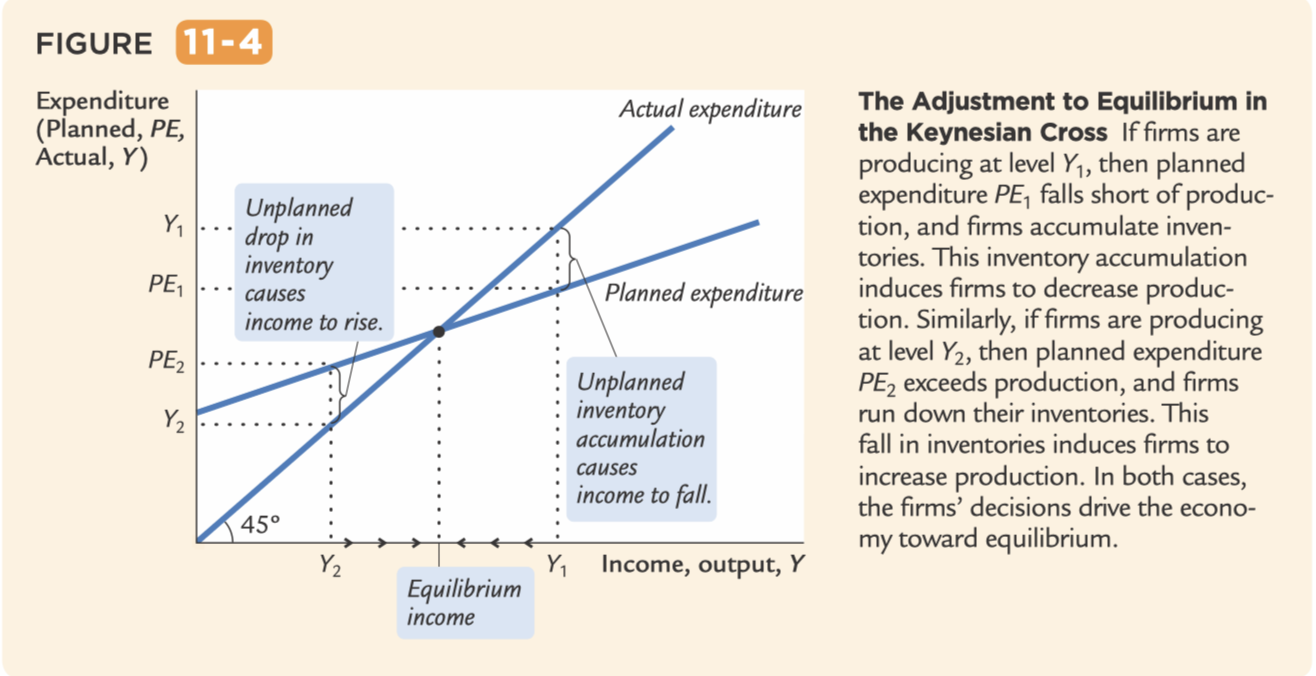

- The marginal propensity to consume (MPC, 边际消费倾向) is the amount by which consumption changes when disposable income increases by one dollar.

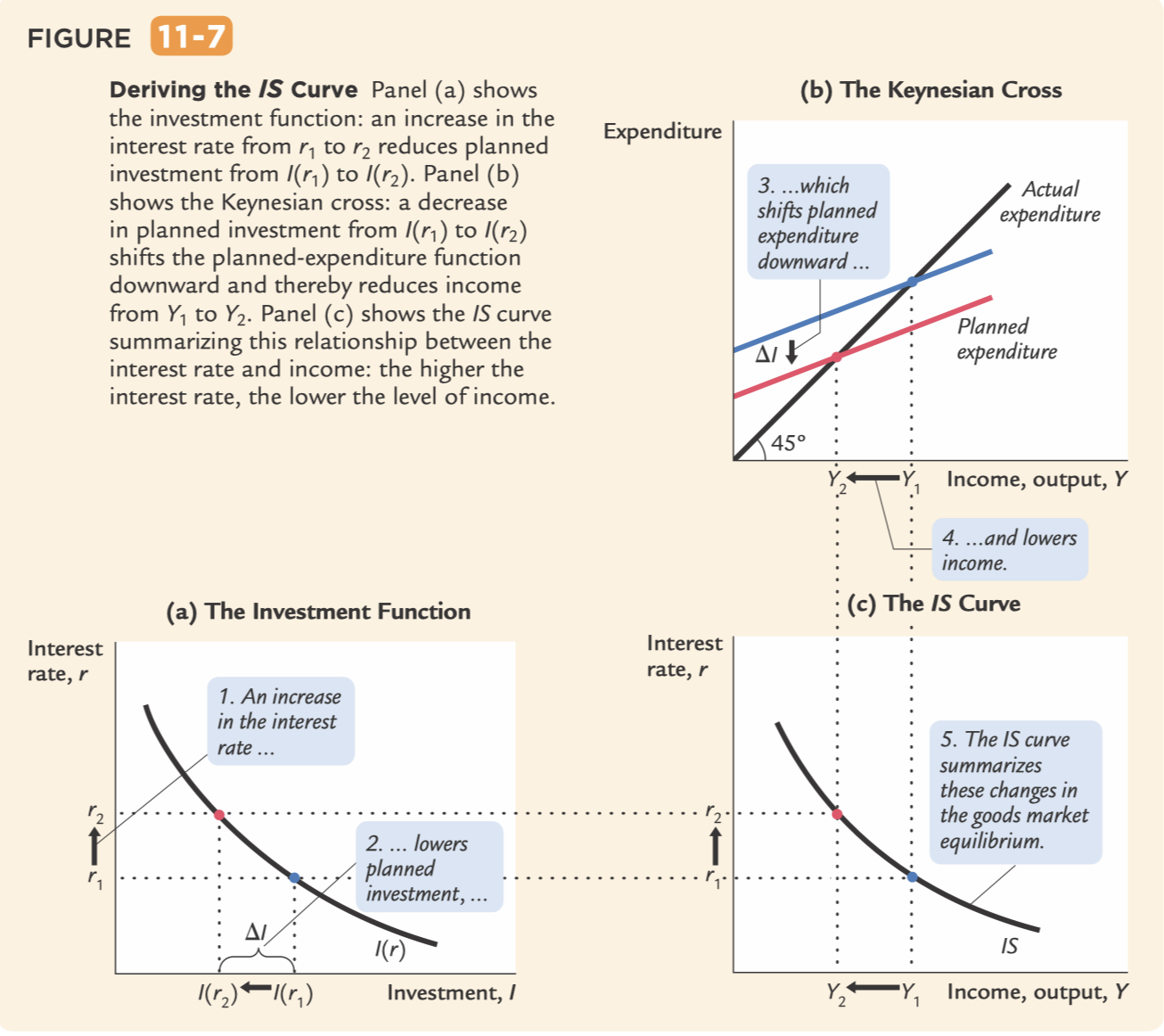

- The quantity of investment goods demanded depends on the interest rate, which measures the cost of the funds used to finance investment.

- The nominal interest rate is the interest rate as usually reported: it is the rate of interest that investors pay to borrow money. The real interest rate is the nominal interest rate corrected for the effects of inflation

- Consumption depends positively on disposable income. Investment depends negatively on the real interest rate. Government purchases and taxes are the exogenous variables of fiscal policy.

- Function of money

- store of value

- unit of account

- medium of exchange

- Money that has no intrinsic value is called fiat money because it is established as money by government decree, or fiat

- Gold Standard: Gold is a form of commodity money because it can be used for various purposes—jewelry, dental fillings, and so on—as well as for transactions.

- Open-Market Operations—the purchase and sale of government bonds.

- Money is the stock of assets used for transactions. It serves as a store of value, a unit of account, and a medium of exchange. Different sorts of assets are used as money: commodity money systems use an asset with intrinsic value, whereas fiat money systems use an asset whose sole function is to serve as money. In modern economies, a central bank such as the Federal Reserve is responsible for controlling the supply of money.

- The supply of money depends on the monetary base, the reserve–deposit ratio, and the currency–deposit ratio. An increase in the monetary base leads to a proportionate increase in the money supply. A decrease in the reservedeposit ratio or in the currency–deposit ratio increases the money multiplier and thus the money supply.

- The Federal Reserve influences the money supply either by changing the monetary base or by changing the reserve ratio and thereby the money multiplier. It can change the monetary base through open-market operations or by making loans to banks. It can influence the reserve ratio by altering reserve requirements or by changing the interest rate it pays banks for reserves they hold.

- This overall increase in prices is called inflation

- the revenue that governments can raise by printing money, sometimes called the Inflation Tax

- M/P, is called real money balances.

- The revenue raised by the printing of money is called seigniorage

- The interest rate that the bank pays is called the nominal interest rate, and the increase in your purchasing power is called the real interest rate

- Fisher equation: \(i = r +\pi\), the nominal interest rate is the sum of the real interest rate and the inflation rate

- Therefore, we must d guish between two concepts of the real interest rate: the real interest rate that the borrower and lender expect when the loan is made, called the ex ante real interest rate, and the real interest rate that is actually realized, called the ex post real interest rate.

- According to classical economic theory, money is neutral: the money supply does not affect real variables. Therefore, classical theory allows us to study how real variables are determined without any reference to the money supply. The equilibrium in the money market then determines the price level and, as a result, all other nominal variables. This theoretical separation of real and nominal variables is called the classical dichotomy.

- This irrelevance of money in the determination of real variables is called monetary neutrality.

- The nominal exchange rate is the relative price of the currencies of two countries.

- The real exchange rate is the relative price of the goods of two countries

- A famous hypothesis in economics, called the law of one price, states that the same good cannot sell for different prices in different locations at the same time.

- purchasing-power parity. It states that if international arbitrage is possible, then a dollar (or any other currency) must have the same purchasing power in every country

- The unemployment caused by the time it takes workers to search for a job is called frictional unemployment.

- Economists call a change in the composition of demand among industries or regions a sectoral shift. Because sectoral shifts are always occurring, and because it takes time for workers to change sectors, there is always frictional unemployment.

- wage rigidity—the failure of wages to adjust to a level at which labor supply equals labor demand

- The unemployment resulting from wage rigidity and job rationing is sometimes called structural unemployment.

- The natural rate of unemployment is the steady-state rate of unemployment. It depends on the rate of job separation and the rate of job finding.

- Because it takes time for workers to search for the jobs that best suit their individual skills and tastes, some frictional unemployment is inevitable. Various government policies, such as unemployment insurance, alter the amount of frictional unemployment.

- Structural unemployment results when the real wage remains above the level that equilibrates labor supply and labor demand. Minimum-wage legislation is one cause of wage rigidity. Unions and the threat of unionization are another. Finally, efficiency-wage theories suggest that, for various reasons, firms may find it profitable to keep wages high despite an excess supply of labor.

- The level of capital that maximizes steady-state consumption is called the Golden Rule level. If an economy has more capital than in the Golden Rule steady state, then reducing saving will increase consumption at all points in time. By contrast, if the economy has less capital than in the Golden Rule steady state, then reaching the Golden Rule requires increased investment and thus lower consumption for current generations.

- The negative relationship between unemployment and GDP is called Okun’s law

- In the long run, prices are flexible and can respond to changes in supply or demand. In the short run, many prices are “sticky” at some predetermined level.

- In the long run, the aggregate supply curve is vertical because output is determined by the amounts of capital and labor and by the available technology but not by the level of prices. Therefore, shifts in aggregate demand affect the price level but not output or employment.

- In the short run, the aggregate supply curve is horizontal, because wages and prices are sticky at predetermined levels. Therefore, shifts in aggregate demand affect output and employment.

- The IS curve plots the relationship between the interest rate and the level of income that arises in the market for goods and services.

![image-20200106211420794]()

![image-20200106212014389]()

![image-20200106212644953]()

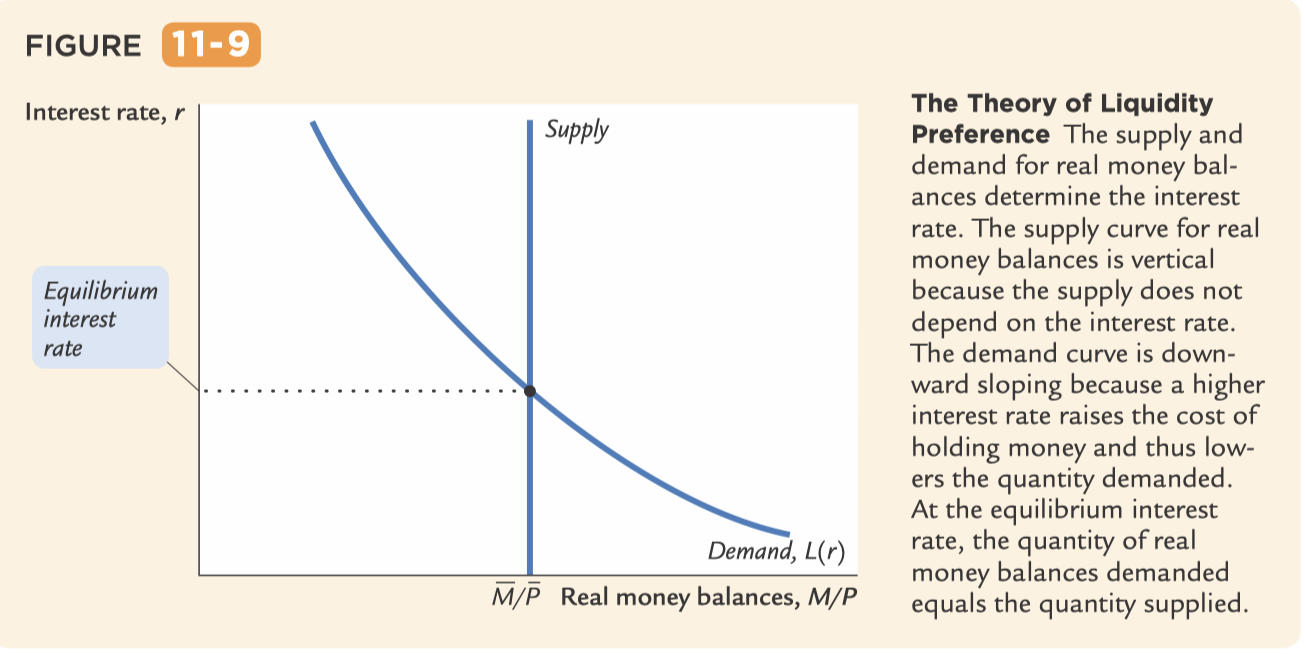

- The theory of liquidity preference is a basic model of the determination of the interest rate. It takes the money supply and the price level as exogenous and assumes that the interest rate adjusts to equilibrate the supply and demand for real money balances. The theory implies that increases in the money supply lower the interest rate.

- Once we allow the demand for real money balances to depend on national income, the theory of liquidity preference yields a relationship between income and the interest rate. A higher level of income raises the demand for real money balances, and this in turn raises the interest rate. The upwardsloping LM curve summarizes this positive relationship between income and the interest rate.

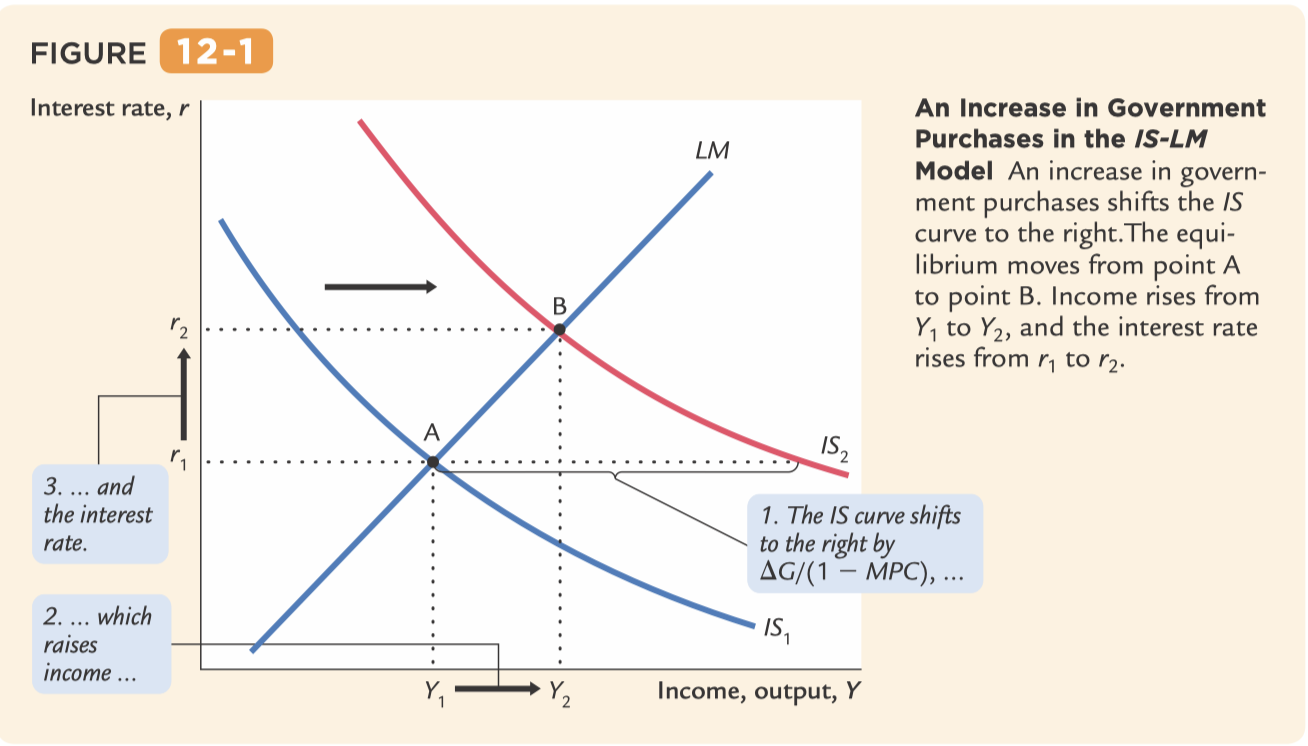

- The IS curve shows the points that satisfy equilibrium in the goods market, and the LM curve shows the points that satisfy equilibrium in the money market. The intersection of the IS and LM curves shows the interest rate and income that satisfy equilibrium in both markets for a given price level.

![image-20200106214110908]()

- crowding out of investment

- monetary transmission mechanism (货币传导机制): An increase in the money supply lowers the interest rate, which stimulates investment and thereby expands the demand for goods and services.

![image-20200106214656591]()

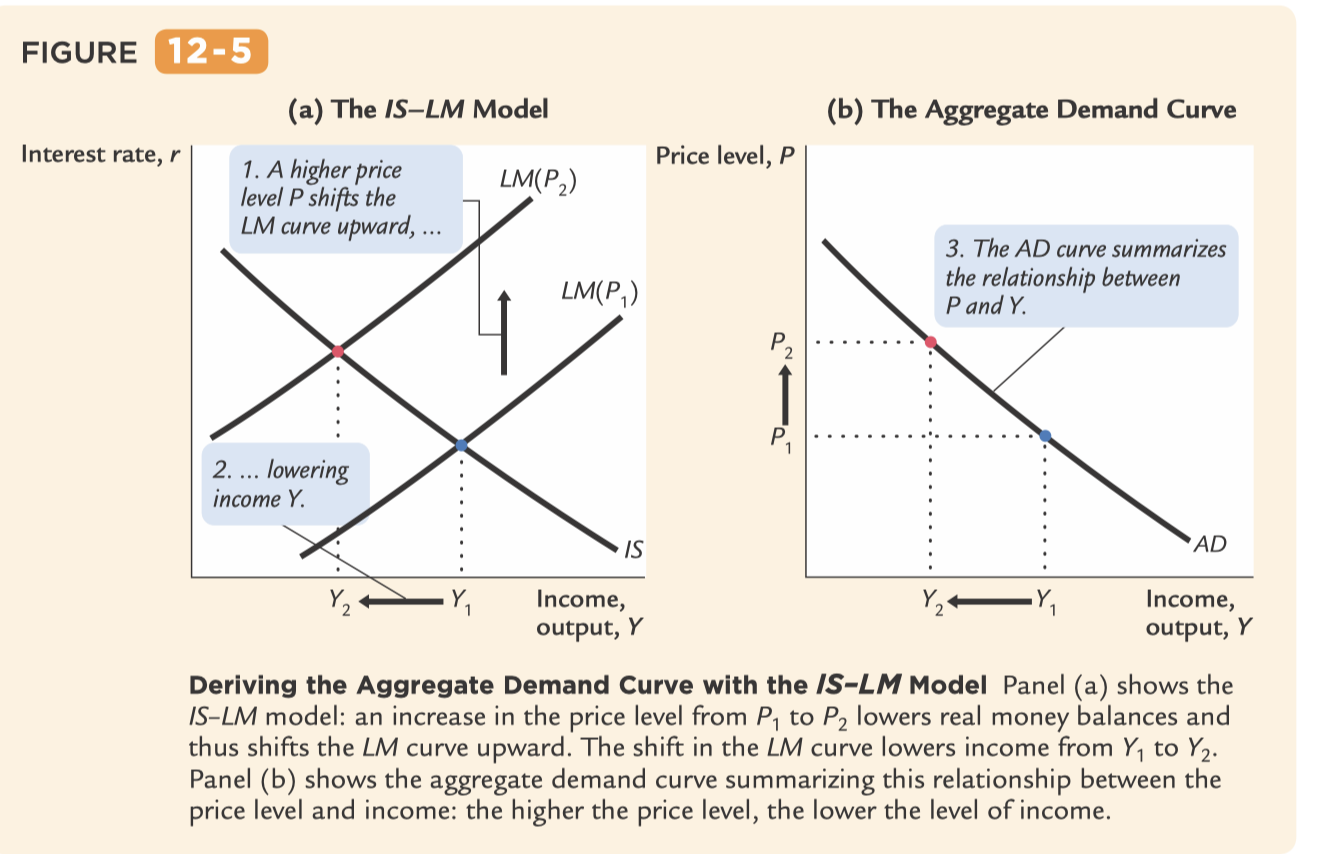

- The IS–LM model is a general theory of the aggregate demand for goods and services. The exogenous variables in the model are fiscal policy, monetary policy, and the price level. The model explains two endogenous variables: the interest rate and the level of national income.

- Expansionary fiscal policy (扩张性货币政策)—an increase in government purchases or a decrease in taxes—shifts the IS curve to the right. This shift in the IS curve increases the interest rate and income. The increase in income represents a rightward shift in the aggregate demand curve. Similarly, contractionary fiscal policy (紧缩性货币政策) shifts the IS curve to the left, lowers the interest rate and income, and shifts the aggregate demand curve to the left.

- The aggregate demand curve summarizes the results from the IS–LM model by showing equilibrium income at any given price level. The aggregate demand curve slopes downward because a lower price level increases real money balances, lowers the interest rate, stimulates investment spending, and thereby raises equilibrium income.

- Expansionary monetary policy shifts the LM curve downward. This shift in the LM curve lowers the interest rate and raises income. The increase in income represents a rightward shift of the aggregate demand curve. Similarly, contractionary monetary policy shifts the LM curve upward, raises the interest rate, lowers income, and shifts the aggregate demand curve to the left.

![image-20200106215929833]()

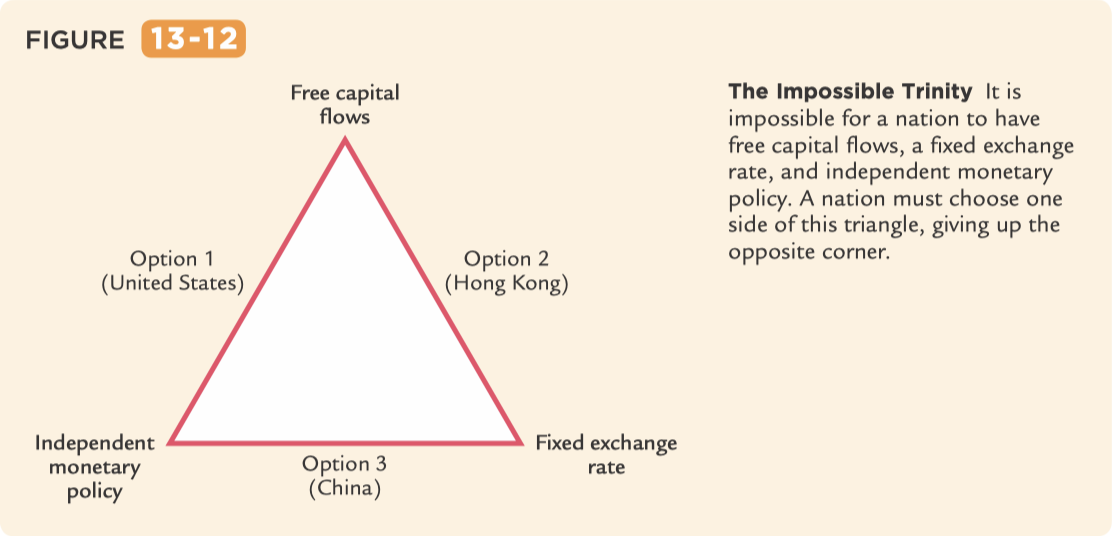

- The Mundell–Fleming model shows that fiscal policy does not influence aggregate income under floating exchange rates. A fiscal expansion causes the currency to appreciate, reducing net exports and offsetting the usual expansionary impact on aggregate income. Fiscal policy does influence aggregate income under fixed exchange rates.

- There are advantages to both floating and fixed exchange rates. Floating exchange rates leave monetary policymakers free to pursue objectives other than exchange-rate stability. Fixed exchange rates reduce some of the uncertainty in international business transactions, but they may be subject to speculative attack if international investors believe the central bank does not have sufficient foreign-currency reserves to defend the fixed exchange rate. When choosing an exchange-rate regime, policymakers are constrained by the fact that it is impossible for a nation to have free capital flows, a fixed exchange rate, and independent monetary policy.

- This tradeoff between inflation and unemployment, called the Phillips curve

- The Phillips curve says that inflation depends on expected inflation, the deviation of unemployment from its natural rate, and supply shocks. According to the Phillips curve, policymakers who control aggregate demand face a short-run tradeoff between inflation and unemployment.